The Oxford Income Letter is an investment newsletter that’s put together by a guy named Marc Lichtenfeld, who is a published author & pro-investor.

You’re led to believe that it will teach you how to harness the power of dividends using Marc’s “proprietary” 10-11-12 System & you’re told that with less than 4 hours of work you can generate an additional $1,038 per week.

But obviously that’s a pretty bold claim & naturally, it’s probably got you pretty sceptical about the whole thing… So what’s the deal? Is it actually legit, or is the Oxford Income Letter a scam that’ll just end up costing you more than you ever make?

Thankfully you’ve landed in exactly the right place to find out as I’ve decided to take a closer look into it & in this honest review I’ll be uncovering the truth about how it works & whether or not it’s actually worth your time (or money). 🙂

What Is The Oxford Income Letter? | Who Is The Oxford Income Letter For? | How Does The Oxford Income Letter Work? | A Better Alternative | Is The Oxford Income Letter a Scam?

What Exactly Is The Oxford Income Letter?

Primarily Marc will talk about dividends as this seems to be his main forte, but on top of that, the newsletter will often contain various other income-producing strategies too, all of which are based on Marc’s 10-11-12 System (to which he attributes most of his success).

So at this point, you might be thinking, well just who is this Marc guy? After all, if you’re following investment advice you’ll need to be sure that the person you’re following it from can be trusted & knows his stuff.

All too often I come across fake or over-hyped investment products which are primarily designed to make money from people, rather than actually help the people make money. 2 examples that spring to mind are Technology Profits Confidential & The Big Book of Income.

But in this instance, the good news is that Marc is a real person, and he sure does know a thing or 2 about investing. The reason I can say that so confidentially is because Marcs actually written 2 books on the subject & he’s even featured on CNBC, Fox Business and Bloomberg Radio.

His 2 books are titled “You Don’t Have To Drive An Uber In Retirement” and “Get Rich With Dividends”.

They’ve both got excellent recommendations on Amazon, and his Oxford Income Letter newsletter incorporates similar advice to the books – but it also comes bundled with actionable investment advice to help you make money.

The next question you’re probably wondering then is will you be able to make money with it? And that’s obviously the big one. Well, I’m going to talk about that in just a moment but firstly there’s something else that’s pressing…

Free Training:

Who Is The Oxford Income Letter For?

Well technically anybody could sign up to the Oxford Income Letter & take action on the newsletter’s advice but realistically the whole thing is targeted towards retirees (or soon-to-be retirees) & I can tell that from their marketing.

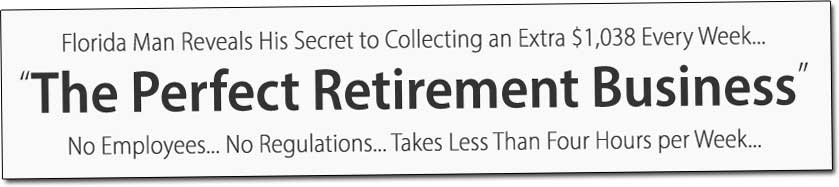

In fact from what I can see the Oxford Income Letter is being primarily promoted via a website which is titled “The Perfect Retirement Business”, and the Oxford Income Letter is sold as a way to rapidly boost retirement savings.

The page states that the average person only has around $12,000 saved for retirement & the Oxford Income Letter is sold as a way to “get an extra paycheck each week” to boost those savings.

The website specifically states (and I quote) that it “involves a special kind of cash-generating “pastime” where regular folks – including you – can rake in $1,038 or more each week“.

It even states that you can “easily clear $54,000 per year“, which is a heck of a lot of money.

And those kinds of claims make it sound too good to be true. In fact to be honest they make it flat out sound like a scam.

You see the reality in life (as you probably know) is that there is no such thing as easy money. You either put in the work to make money, or you take risks to make money… Which could alternatively result in catastrophic losses.

So what’s the deal? How can the Oxford Income Letter boast such high returns? All that will be explained below when I show you how it works…

You Might Also Like:

How Does The Oxford Income Letter Work?

Well, essentially there are 3 parts to the Oxford Income Letter. There’s the newsletter itself, which comes once a month… Then there’s a weekly update that will give you information regarding the 4 portfolios talked about in the newsletter & finally, there’s a “blast” which can be sent to you at any time to notify you of alerts.

In terms of making money from the picks you’re providing with via the newsletter, the answer is yes… You can potentially make money, however, this is the part where I have to tell you that it’s not quite so great as it seems.

I mean don’t get me wrong, a lot of long term members do report having success with the newsletter, but there is absolutely no guarantee & the truth is that you could in fact just end up losing money.

There is also absolutely no promise of $1,038 per week & achieving that level of income would require a substantial upfront investment, which again is something that you could potentially lose.

So whilst I believe the Oxford Income Letter to be much better than many of the other investment newsletter I’ve seen (such as the Secret $20 Blueprint), it is still very hyped up which could lead to disappointment.

At the end of the day though putting the hyped-up sales page aside, I do believe that at a cost of $129 the Oxford Income Letter is fairly reasonably priced. However, you must be careful because if you sign up to it then you will be automatically enrolled for the subscription to “auto-renew” for the second & following years.

This is a trick that seems to have caught many people out as there are many complaints from people who’ve been charged without knowing about the auto-renew feature (which is not surprising because it’s shown in very small font compared to the rest of the text on the order page).

But There’s a Better Alternative…

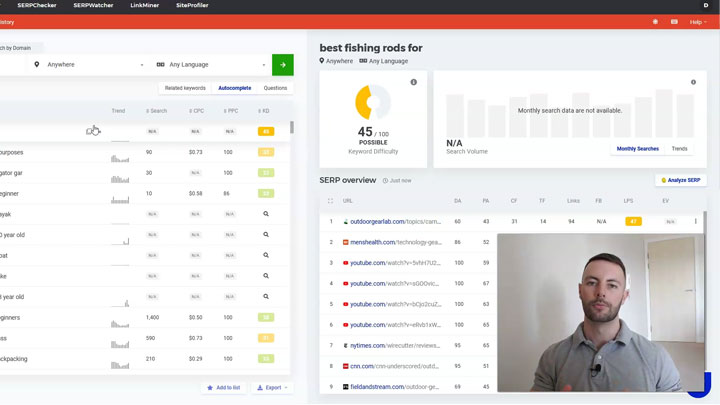

Well, at least in my opinion there’s a better alternative – in fact, there’s actually a few. I mean take social trading for example. Essentially you’re paying $129 to get monthly updates from Marc, yet over at a social trading site like eToro you could follow & copy pro-traders with live updates for free…

And then there’s affiliate marketing – I mean I appreciate that it’s a totally different way to make money altogether, but at least there’s no risk involved & you’re guaranteed to make money providing you put in the effort. You could get started with that at Commission Academy.

So whilst you could potentially make money with the Oxford Income Letter, I would save your cash & roll with one of the alternatives above instead. If Marc was guaranteeing profits via his newsletter then, of course, it would be a different story, but he’s not.

My Verdict – Is The Oxford Income Letter a Scam?

It’s definitely not a scam. Marc is a real person & the Oxford Income Letter is the real deal, however, what I will say though is that a lot of the websites I’ve seen promoting it are massively over-hyped.

If you are seeing it as a way to generate easy money with little to no risk then think again, because that’s not how it works. There is always big risk involved in trading, that’s the nature of it… And the more you stand to make, the greater the risk.

But if you have a lot of money to start up with, and you are not afraid of losing it all then, by all means, feel free to try the advice offered via Oxford Income Letter – but do remember about the “auto-renew” feature.

However, I’m not gonna lie overall I’m not personally going to be recommending it because I just don’t see the purpose of paying for investment advice when there is plenty available for free via social trading sites.

And ultimately I feel that the way I personally make money online is just a much better alternative because at least it contains no element of risk & you don’t need to spend lot’s of money to get started with it.

So it’s up to you what you decide to do, but I just hope my review here has given you a good insight into how it all works & I hope it will help you to make a better decision as to whether or not it’s really right for you. If you do still have any further questions or comments though then don’t hesitate to leave them below & I’ll get back to you as quickly as I can. 🙂

I have to agree, Marc Lichtenfeld’s book “Get Rich with Dividends” was a decent read. But that led me to the stupid decision to subscribe to his Stock Sequence Trader’s advisory service offered by the Oxford Club. This trade recommendation service is supposed to pick companies which are potential candidates to be bought over or targeted to start issuing dividends. Mind you, the subscription is not cheap, setting me back almost $1,600 for an annual subscription. It’s worth the price if Marc Lichtenfeld picks were good. But they weren’t. Recently his few picks suck badly. These companies have very bad fundamentals and their share prices drop the moment their earnings announcement were made. They were hardly the type of candidates to be acquired or issue any sort of dividends. The sucker punch was Marc Lichtenfeld recommended subscribers to buy call options to leverage our potential to earn higher profits in case the anticipated event(s) did materialize. But they didn’t. And since these companies’ share prices crumble after earnings, the call options were all reduced to sub pennies, where some of these calls were bought at few hundreds per option contract. So my warning is, don’t spend your hard earned money on Marc Lichtenfeld Stock Sequence Trader service. And be careful of the Oxford Club too. They refuse to let me cancel my subscription to get back my refund repeatedly.

Thanks for your detailed comment Tony, appreciate the insight 🙂

I filled out the form to get Marc’s Oxford’s dividend letter. This was a few days ago and I have yet to hear a word. My credit card is not to be peddled to other services. I gave you a second credit card that should be enough. I have printed the last eight pages of your enrollment form. I have tried to reach you for 2 days and so far only crickets. I spent 6 years as an Infantry Officer, Ranger and Special. I will not be *swear word removed* into paying for nothing. I spent 50 years as a professional money manager. I spent time with Fidelity, Barings asset management where I managed funds for GM,Yale and other endowment plans. I retired from Oppenheimer funds after 10 years. we increased the AUM from $15 Bill to over $125 billion. I bought my first stock in may of 1965. Hard to believe that I bought Berkshire for $9 dollars and sold it a year later for about the same.

Hi Len, you do realize you’re writing your comment on the website of a 3rd party reviewer? You certainly didn’t give me your second credit card (nor would I ask for it) and you certainly haven’t printed any 8 pages of “my” enrolment form. You might have tried to reach somebody, but it wasn’t me.

I think he was talking about Marc and his newsletter. My question to him would be, “with all your experience, why were you even looking at stuff like this?”

>> I spent 50 years as a professional money manager. <<

With all this experience, how could you be so gullible with this Texan style money preacher.

I’m 71 & have ZERO experience w/investing! I read the emails & wonder but have NEVER tried ANYTHING as I have NOTHING to invest! I live below the poverty level on a minimum social security check. I have lived in rent control for 21 years. I’m concerned that my building will be raised & i will become homeless. Though i would be given relocation fees, those monies would disappear rather quickly & i would be homeless again. I may be receiving a small inheritance & would dearly love to find a TRULY SAFE place to invest it so that I won’t need it to survive. It’s a sad statement of a society who takes their elderly & makes them homeless!!! I have been blessed w/extraordinarily great health & do a great deal of volunteer work as an alternative health care practitioner. I feel that I am stuck between a rock & a hard spot & am slowly being crushed! Got any ideas???

Hi Joyce, given what you’ve told me I definitely would not recommend investing. In my opinion investing is something that should only be done with money you have to spare, and it should never be looked as something that can provide a quick or extraordinarily large return. Currently from what I’ve read the average return on a moderately risky investment is only as high as 5%, so unless you are investing a very large amount the returns are not going to provide something you could live of. In my opinion you would be better off picking an option whereby you put in work for money, rather than money for money, and you can check out those options on my top picks page here.

Does Marc Lichenfield have anything to do with profitblast. He was not very through I was not able get info from his site. The on ly thing that was clear was the 1,500 dollars he wanted for his services. I don’t even k now what I bought. I hope I’m able to get a refund, that kind of money is hard to come by on social security. I wish I would have never heard of him.

After listening to a mostly redundant and 100 % self-serving oration, I couldn’t help but think of the tired old cliche: ” If it sounds too good to be true, then it probably is”.

Yep, exactly Jim.

You would be much better off subscribing to “The Dividend Hunter”. Since joining 2 years ago, I can testify that the Income produced from “The Dividend Hunter” Portfolio is well over 8% since they began the service in 2014. Now in 2021, and after Covid 19 correction…Our portfolio is producing an average return of 10.18% and growing every month! We are not adding any new money, so the increases come from dividend increases from the companies owned in the portfolio. We have 18 positions across 9 sectors for diversification, stable companies that have continued paying dividends throughout market corrections is a “sleep at night” portfolio. WHEN the market corrects again, (And it will) we will just sit back and watch…buy more shares as the account is set-up in (Auto-Reinvest). And watch our monthly income increase.

I have been a subscriber for a couple of years, and agree with what Tim Plaehn is saying, but I have never been able to get any answers for HOW to implement the investments, or WHO I need to be the intercessor for actually buying the stocks. Knowledge and desire and $$$$ does not good without the VESSEL. 🙁

Let me add to my earlier comment that I will cancel my second credit card which you know the card numbers to access my funds. USAA is a strong Financial Com.

and will reverse any charges you make!

Please read my previous response. I am a third-party reviewer.

Does Marc L. (or Agora) pay big money to big celebs to endorse him and his investment letter? Such celebs as Bill O’Reilly and Kudlow. It is hard to imagine these t.v. hosts would damage their reputations and credibility for a few dollars. They are both very wealthy men. But I have noticed that when one has a new product (or old product in a new wrapper) they always fine a celeb to make the pitch; it must be someone that people would absolutely trust. Tom Selick for Reverse Mortgages come to mind.

In the t.v. program “American Greed” scammers play on credibility provided by celebs (sometimes posing as one) and satisfied investors that are really investing in a Posi scheme without knowing it. Sometimes they get away with it for years.

What are your thoughts on Bill O’Reilly and Kudlow pitching for Marc L.? It seems a bit tawdry to me and risky for them. Thanks

Often these people don’t even know what/who they’re promoting. I’ve seen it so many times over the years. You have to remember that their agents are coming at them with hundreds of these opportunities every day so they generally don’t do their own due diligence & simply trust their agents. As to whether or not this is the case with those you mention, I’ve no idea – but the key is not to take “personal” endorsements as being personal at all. They likely only heard about the company 2 minutes prior to endorsing it.

Hi Dale, I used Marc’s countdown period before signing on with my credit card details. To read your comments and the experiences of others.

Thank you and your readers. I did NOT sign on.

Daryl

Glad to hear you dodged it 🙂

Hello Dale,

I subscribed to the newsletter. I figured dividend stocks would be something I would always have in my portfolio, so when they offered a lifetime subscription I figured why not. In the second year they added a “maintenance fee” of $15/yr which seemed pretty steep for a $49/yr normal subscription. I ended up requesting they remove that charge since I didn’t agree to it and it wasn’t on my “welcome email” that listed out the program for me. They ended up cancelling my subscription without any sort of refund for the lifetime costs. I am out the initial cost so caveat emptor to anyone considering a subscription.

I was stopped out of a few stocks that were recommended, so it was a pretty painful lesson for me. The information you will get is pretty basic and is comparable to what you would get for free on the web.

Overall it was a complete joke and not worth your time if you are considering it to anyone reading this.

Thank you for sharing your experience, Rob 🙂

So, how does a potential investor actually purchase the desired stocks/companies to get these dividends? Brokers? Self directed places?

Brokers via their recommendations – essentially this is just a newsletter making recommendations.